tax forgiveness credit pa

For example if your business claims 500000 of Employee Retention Credit for Q1 2021 then it must reduce the wages deducted on its 2021 income tax return by 500000. May I use the same payroll for PPP forgiveness the ERC FFCRA and WOTC.

Taxes 101 5 Things To Know Before Filing Your Taxes

Are you eligible for a discount.

. It should be noted that no matter how much you spend CEUs can usually be written off as a tax-deduction when you file your tax returns. Empower FCU is utilizing the SBA Paycheck Protection Program Direct Forgiveness Portal - Click for more information. You may qualify for penalty relief if you made an effort to meet your tax obligations but were unable due to circumstances beyond your control.

FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING 2100110051 PA-40 Pennsylvania Income Tax Return PA-40 EX MOD 06-21 FI PA Department of Revenue Harrisburg PA 17129 START OFFICIAL USE ONLY 2021 OFFICIAL USE ONLY. Important-The amount of loan forgiveness you will receive later is dependent upon proper use of the loan. The ERC credit is subject to income tax on your 2021 tax return.

Advance Child Tax Credit. PA CT NY and NC. Remember though you often get what you pay for and many of the best learning experiences can be expensive.

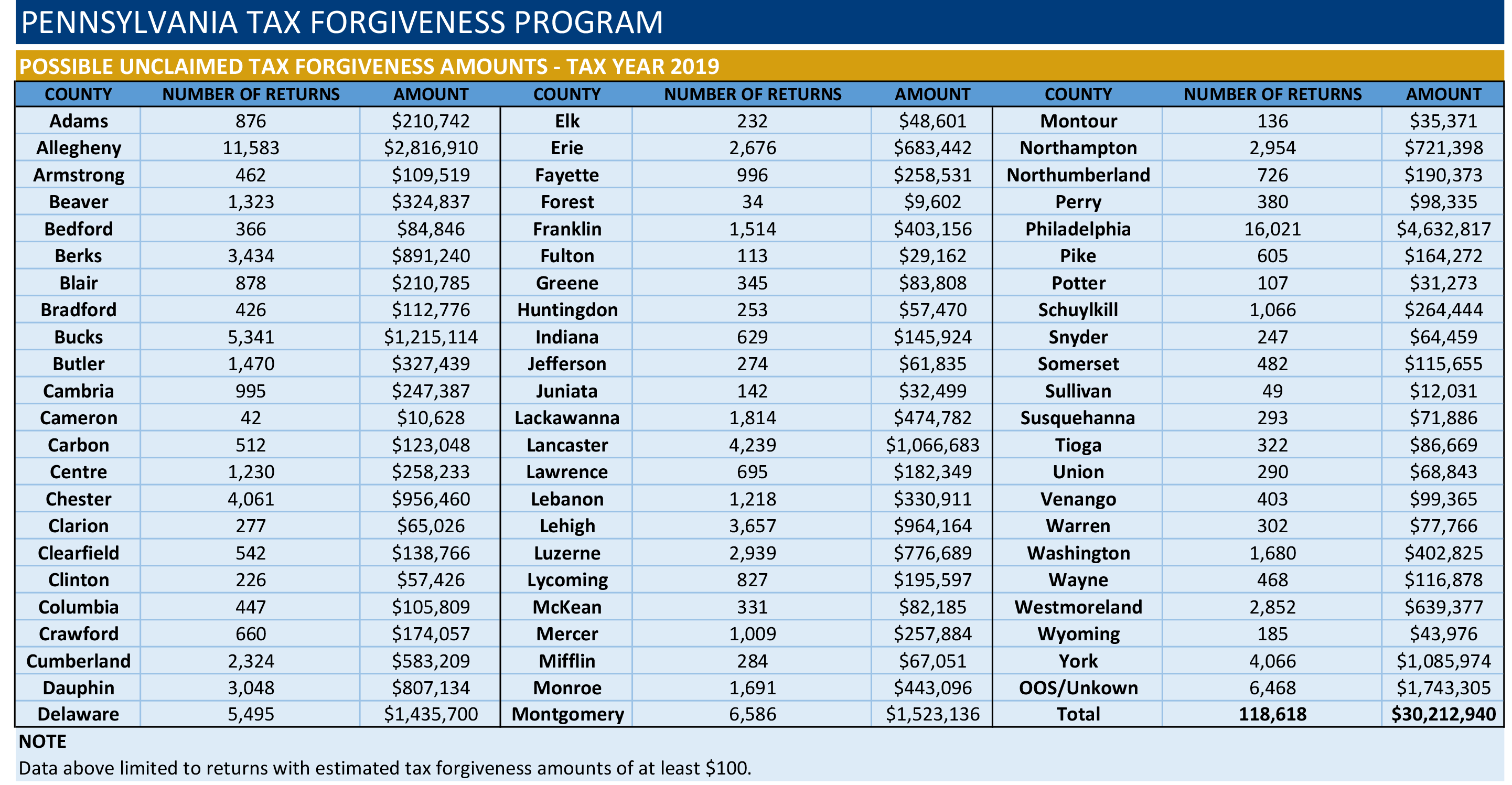

Loss and Credits Tax Credit. Philadelphia residents who qualify for PAs Tax Forgiveness program can get a partial refund of city wage tax withheld by their employer. Number of employees as of 01312020.

Taxes withheld estimated tax payment and credits except the Tax Forgiveness Credit from Lines 13 14 15 17 22 and 23 of the pro-forma PA-40 will also be reported as payments and credits for the bankruptcy estate. WOTC Work Opportunity Tax Credit is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. Line 18 Total Withholdings and Payments.

Find an approved credit counseling agency through the US. It is designed to help individuals with a low income who didnt withhold taxes throughout the year and those who are retired. S Web site at wwwirsgov or call the IRS toll-free 1-800-829-1040.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program. Line 21 Tax Forgiveness Credit.

Also you should include tax returns for the preceding year four years for Chapter 13 bankruptcies. To learn more about the PA. Business owners information including name address social security number place of birth confirmation of US citizenship cell phone number and percentage of ownership.

Add Lines 13 through 17 for Column A and C. Most recent tax return. Income-based Earnings Tax refund.

Let Empower Federal Credit Union assist you with all your financial needs. Find out how to get a copy or transcript of your tax return. Pennsylvania Income Tax Return 2021 Pennsylvania Income Tax Return PA-40 IMPORTANT.

221380127 3154772200 8004625000. If youre approved for tax forgiveness under Pennsylvania 40 Schedule SP you may be eligible for an income-based Earnings Tax refund. Line 17 Nonresident Tax Withheld from PA Schedules NRK-1 Nonresidents only 17.

31 2021 can be e-Filed together with the IRS Income Tax Return by April 18 2022If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face late tax payment. Take a pre-filing credit counseling and post-filing education course to have debts discharged. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees.

The 2021 Pennsylvania State Income Tax Return forms for Tax Year 2021 Jan. Jimmy Panetta CA-20 Don Beyer VA-08 Mike Kelly PA-16 Cathy McMorris Rodgers WA-05. People who meet the criteria can receive a refund of up to 05 on City Wage Taxes that their employer withheld from their.

See IRS Publication 970 for detailed information on claiming this deduction. PA-41 Schedule A - Interest Income and Gambling and Lottery Winnings. Tax relief can be a big help because it can reduce or even completely negate the taxes you owe.

No discounts are available for the Earnings Tax. Complete Lines 19 and 20 on Amended PA-40 21. POPULAR FORMS.

Line 22 Resident Credit Based on the instructions for PA-40 Line 22.

Carangue Carangue Pa Cpas Home Facebook

Form Pa 40 Fillable 2014 Pennsylvania Income Tax Return

Pennsylvania Department Of Revenue Parevenue Twitter

Blog Watson Associates Pa Cpas

2022 2023 Tax Brackets Rates For Each Income Level

What Happens If I Miss A Chapter 13 Plan Payment

What You Should Know About Debt Relief Scams

Pennsylvania Pa Debt Consolidation Debt Relief Programs Credit Card Debt Forgiveness Debt Relief

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue Parevenue Twitter

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Form Pa 40 Fillable 2014 Pennsylvania Income Tax Return

2020 Tax Strategy Update Get The Most Out Of The R D Credit Stambaugh Ness

Pennsylvania Department Of Revenue Parevenue Twitter

The Advantages Of Hiring A Personal Injury Lawyer Http Krasneylaw Net Blog The Medical Billing Affordable Health Insurance Plans Affordable Health Insurance

Liens And Levies Md Va Pa Strategic Tax Resolution Tax Debt Debt Relief Irs Taxes